28+ mortgage default rates 2022

Web Under the effects of the coronavirus crisis the mortgage delinquency rate in the United States spiked to 822 percent in the second quarter of 2020 just one percent down from its peak of 93. Web The number of borrowers who are three or more payments past due on their mortgage is up 55 over pre-pandemic levels according to new data from mortgage technology and data provider Black Knight.

Default Transition And Recovery U K Based Defaults This Week Boost The European Corporate Default Tally To A New High S P Global Ratings

Mortgage rates were set to rise to 4-5 over 2022 before the mini-budget.

. Expenditure Financial institutions Housing prices Labor Loans Mortgages Prices Unemployment benefits Unemployment rate Frequency. Web It said. Mortgage delinquencies may be underreported during public emergencies.

12 down from 13 in January 2021. Web Generally purchase mortgages have higher risk attributes relative to refinance loans. The auto loan default rate was up four basis points to 053 while the first mortgage default rate was three basis.

Web Because the effects of the accounting change on the dollar volume of loans reported on banks loan books were small the effects of the accounting change on banks charge-off and delinquency rates were presumably small for the industry as a whole. The highest default rate since September 2020. Add to Data List Add to Graph Expand All Collapse All Q1 1985 Q4 2022.

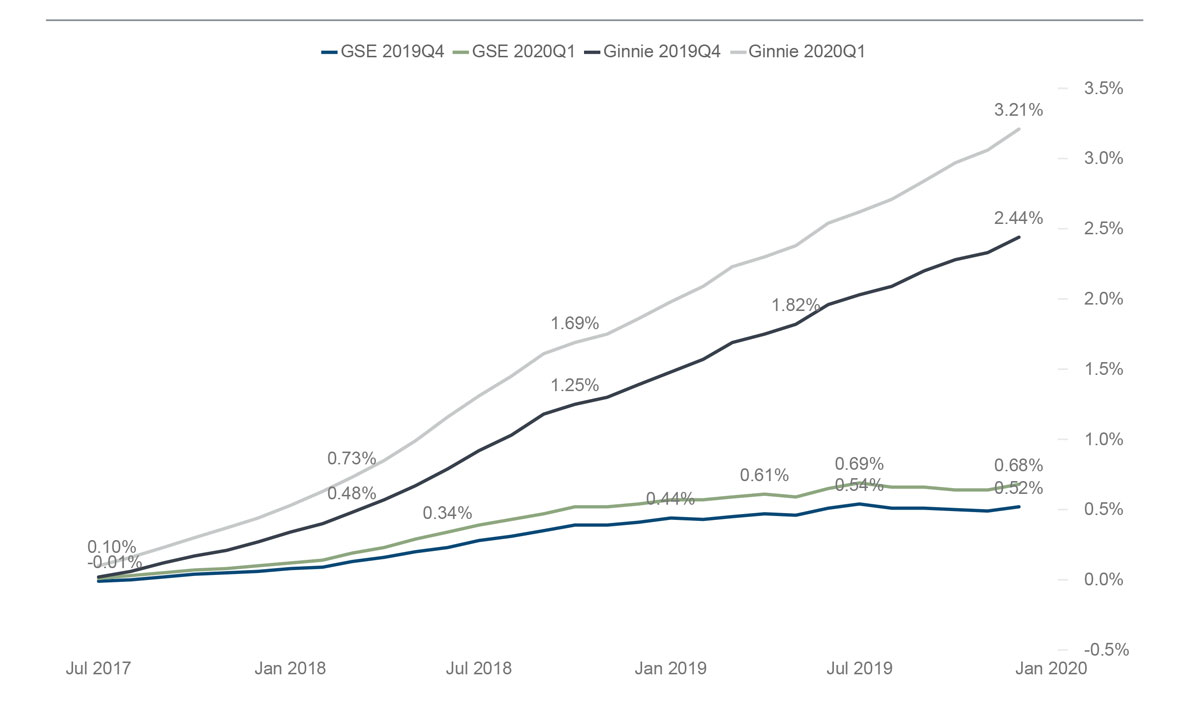

Web For government-sponsored enterprise GSE loans borrower risk increased from 143 in 2022 Q1 to 158 in 2022 Q2. This is a switch from the last several quarters where refinance loans took up the majority of originations. The percentage of loans in the 30 days delinquent bucket is 009 percentunchanged for the month.

The nations overall delinquency rate for June was 29. Web In August 2022 the US. Web Delinquency Rates for All Banks.

Web The Trepp CMBS Delinquency Rate in August 2022 was 298 percent a decrease of eight basis points from July. 121 123 150 Residential Booked in. Other default rate series averages may be higher or lower depending on the universe.

Low transition rates indicate that fewer borrowers slipped into delinquency than at the peak of delinquency rates in 2020. Web The current rate of 1 is close to the all-time low. Purchase loans made up the bulk of loan originations at about 62 of total originations.

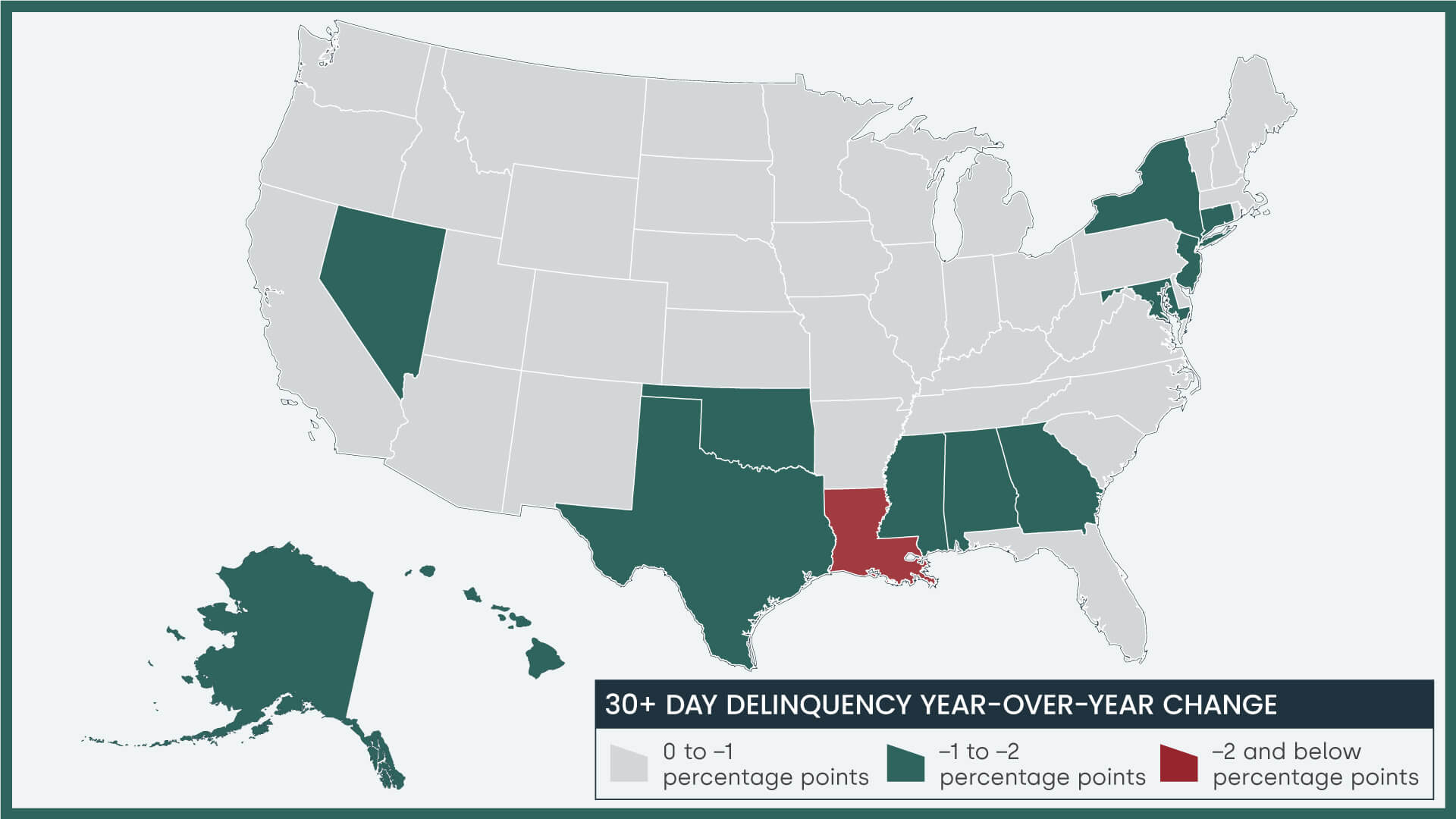

Early-Stage Delinquencies 30 to 59 days past due. CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance. CSV files with data by state 38 KB metro and non-metro areas 229 KB or county 338 KB.

Web The economics of debt moratoria and guarantees are discussed against the background of the model-based analysis. Web The share of mortgages that transitioned from current to 30 days past due was 08 in February 2022 down from 09 in February 2021. The index value of the MMDI was 354 for loans originating in 2022 Q3 compared to 302 for 2022 Q2 originations.

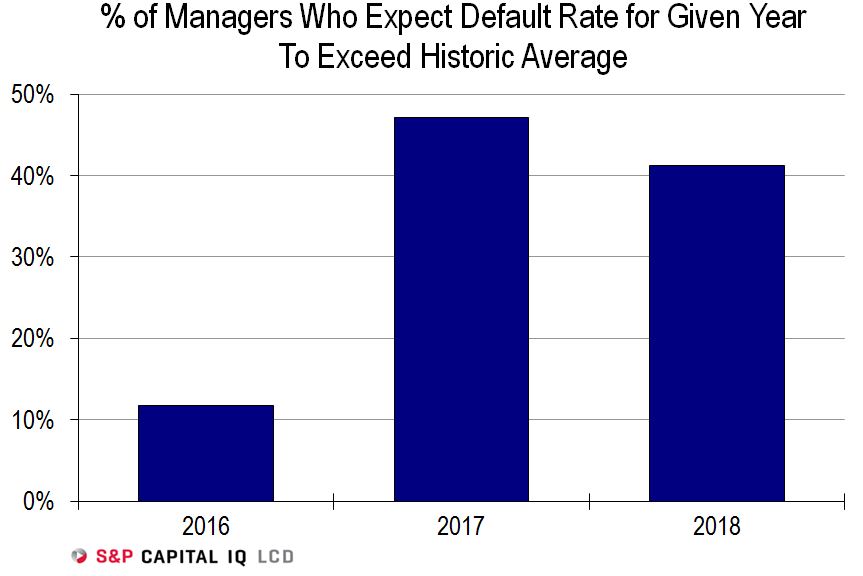

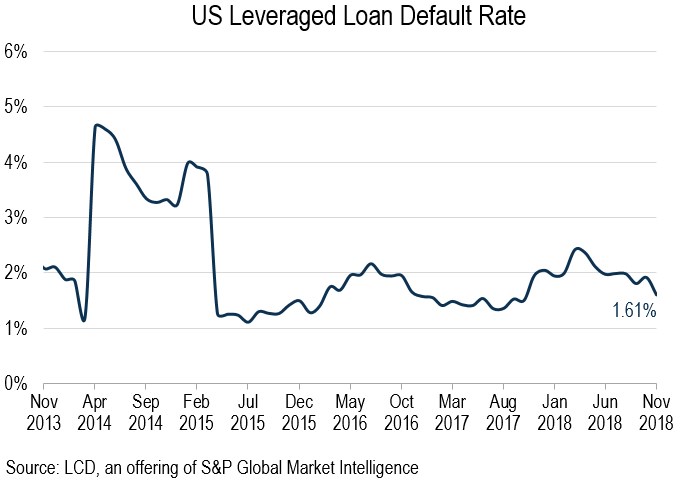

Figure 1 provides the quarter-end index results segmented by purchase and refinance. Web Our 2022 LL and HY default rate forecasts remain unchanged at 15 and 1 respectively given defaults are generally on pace with this level. Web state view for June 2022 Delinquency rates Insuff.

Name Q4 2022 Q3 2022 Q4 2021 Quarterly Seasonally Adjusted. Web The SPExperian first mortgage default index stood at 036 as of May 2022 meaning that based on data from the most recent three months the annualized share of default first mortgages was. Web Loan Performance National.

This together with increases in the cost of living was starting to weaken demand for homes over the. We raised our 2023 default rate forecasts by 25bps to 15-2 for LL and 125-175 for HY. Those at-risk loans hold balances between 95 billion and 151 billion with a conservative estimate of balances at risk of 114 billion.

Web The bank card default rate increased seven basis points to 202. Web Breaking the total default rate down the first mortgage default rate was up four basis points to 042. Data 0 1 2 3 4 5 Source.

Additionally the bank card. Data Report Global speculative-grade corporate default rate was unchanged in November 14 Dec 2022 Moodys Investors Service. National Mortgage Database Date published.

Early-Stage Delinquencies 30 to 59 days past due. Delinquency and transition rates and their year-over-year changes were as follows. The delinquency rate has now fallen for 24 of the last 26 months.

Web In January 2022 the delinquency and transition rates and their year-over-year changes were as follows. For example the Moodys Global Speculative-Grade index has an average default value of 38 with a peak of close to 14 and a low of about 1. Web The global speculative-grade corporate default rate edged up to 28 for the 12 months ended in December from 26 in November and will rise to 51 by the end of 2023 under our baseline forecasts.

The share of mortgages 60 to 89. States With the Highest and Lowest Rate of Mortgages At Least 30 Days Past. The rate for early-stage delinquencies defined as 30 to 59 days past due was 12 in June 2022 up from June 2021.

12 up from 11 in August 2021. Web Graph and download economic data for Delinquency Rate on Single-Family Residential Mortgages Booked in Domestic Offices All Commercial Banks DRSFRMACBS from Q1 1991 to Q4 2022 about domestic offices delinquencies 1-unit structures mortgage family residential commercial domestic banks depository. Web Consequently we can approximate between 64000 and a little over 100000 mortgages will be at risk of a default in Louisiana over the next few months.

Us Leveraged Loan Default Rate Falls For 6th Consecutive Month To 3 15 S P Global Market Intelligence

8hzsvtenxe5ukm

Europe Corporate Default Rates Set To Stay At Historic Lows S P S P Global Market Intelligence

When Will Leveraged Loan Default Rates Finally Rise Here S What Loan Managers Say S P Global Market Intelligence

National Mortgage Delinquencies Reach Another New Low In May Rismedia

Mortgage Default Index 2020 Q1

Loan Performance Insights September 2022 Corelogic

Loan Performance Insights September 2022 Second Edition Corelogic

Loan Performance Insights September 2022 Second Edition Corelogic

Mortgage Delinquencies Settled In 2021 But Are Looking Up In 2022

4020 Sally Brown Rd Muskogee Ok 74403 For Sale Mls 2238865 Re Max

Loan Performance Insights December 2022 Corelogic

Us Leveraged Loan Default Rate Falls For 6th Consecutive Month To 3 15 S P Global Market Intelligence

Us Leveraged Loan Default Rate Falls For 6th Consecutive Month To 3 15 S P Global Market Intelligence

Loan Performance Insights September 2022 Second Edition Corelogic

Quick Take Global Default Rates Rise To Highest Levels Since 2009 S P Global Market Intelligence

Us Leveraged Loan Default Rate Dips To 1 61 S P Global Market Intelligence